South Africa’s freight backbone is in crisis. The Durban/Gauteng corridor, meant to be the country’s most strategic artery, has seen rail volumes collapse while trucks swamp the N3 in unsustainable numbers. The Port of Gauteng White Paper, unveiled at the start of Transport Month, sets out a R50 billion private-sector response – a massive inland logistics hub designed to make rail competitive again while achieving new road freight efficiencies through Performance-Based Standards (PBS) trucks. FleetWatch correspondent Paul Collings reports.

Francois Nortjé, Developer of Port of Gauteng, frames the plan in bold terms. “We’re creating Africa’s most advanced inland trade gateway. This facility represents our commitment to solving South Africa’s freight crisis while generating massive economic returns. The 50 000 permanent jobs are just the beginning; we’re creating a platform for decades of sustainable growth.”

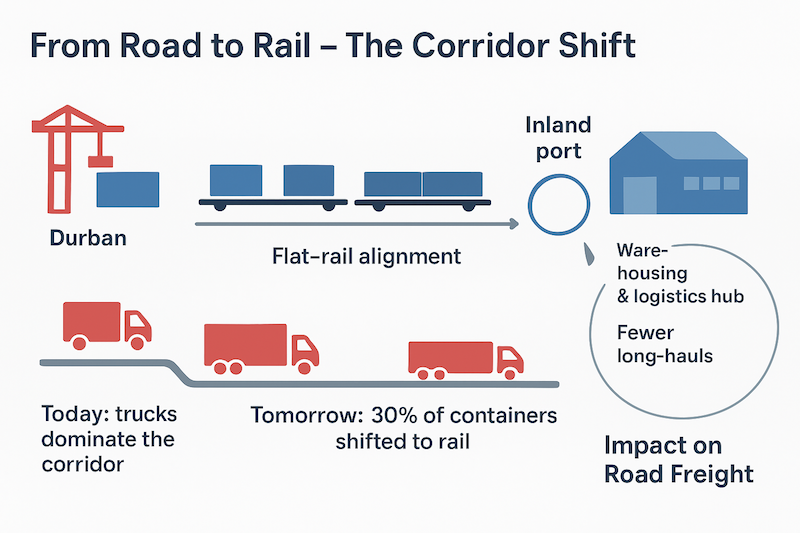

The project covers 1 400 hectares at the junction of the N3, N12 and N17, directly on the Container Rail Corridor. Two 2.2 km flat rail alignments are at the core of the design, built to handle 750-metre trains with targeted three-hour turnaround times.

Alongside them will sit a container terminal, a world-class car terminal and integrated green infrastructure such as rooftop solar, rainwater harvesting and advanced recycling systems.

The freight crisis in numbers

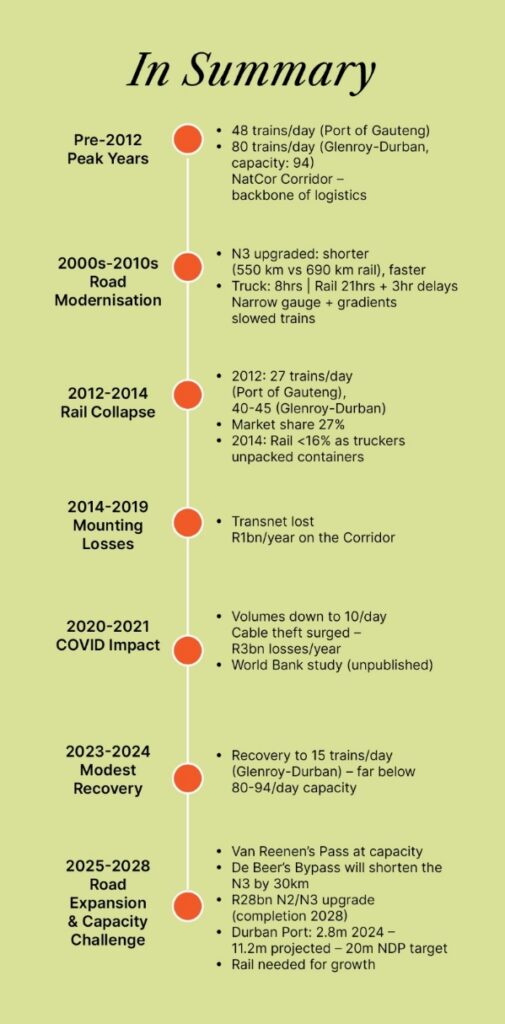

The White Paper spares little detail in diagnosing the current malaise. Transnet lost R1-billion annually on the corridor between 2014 and 2019, rising to R3-billion during Covid. Train movements plummeted from 80 a day to around 15 by 2023-24.

The 2013 National Development Plan (NDP) set a target that half of long-haul freight should move by rail by 2030. With four years to go, less than 14 percent is on rail.

“Since the 2013 National Development Plan set ambitious 2030 targets for shifting freight from road to rail, little progress has been made – and with just four years to go, the need for decisive action is urgent,” says Nortjé.

E-commerce surge adds to the strain

South Africa’s freight pinch is being amplified by the rapid entry of global online retailers. Platforms such as Temu, Shein and Amazon are scaling their African presence, pushing containerised imports sharply upward.

These players may start with air freight but as volumes grow, they inevitably switch to sea freight, adding new pressure on Durban’s already stretched terminals and the inland corridor to Gauteng.

The white paper flags this trend as a structural shift in the market – one that makes reliable rail and high-capacity trucking solutions even more urgent.

Making rail competitive again

The developers believe reliability is the missing link. By offering rapid turnarounds and guaranteed slots, the Port hopes to restore shipper confidence in rail. “Port of Gauteng changes everything. It provides the missing link that makes rail competitive again,” says Mike Daniel, CEO of RailRunner South Africa.

“With purpose-built rail alignments and future three-hour turnaround times at the container and car terminals, we can finally deliver the reliability that shippers demand,” he adds.

The model envisages private operators moving trains on newly competitive terms, reducing costs per container and making long-haul rail once again attractive compared with road.

Unlocking smarter trucking with PBS

The White Paper is equally ambitious about road freight reform. Performance-Based Standards vehicles – longer, more stable combinations capable of carrying two containers each – are positioned as the key to cutting congestion. By matching PBS operations with rail flows, the developers believe they can remove up to 40 percent of truck movements from the N3 while still improving efficiency.

According to Dr Paul Nordengen, Director at Heavy Vehicle Transport Technology Africa: “Port of Gauteng’s integration of PBS vehicles represents the most significant advancement in heavy vehicle transport efficiency we’ve seen in decades, reducing truck movements by up to 40% and improving safety outcomes on our most critical trade corridor,”

For fleet operators the numbers are significant: two containers per trip, safer handling dynamics, and lower per-unit emissions.

Regulatory hurdles remain

The challenge is that PBS remains a pilot scheme. Government is considering a three-year extension to the pilot before deciding whether to legislate it permanently. That leaves operators in limbo – reluctant to commit capital to new trailers, training and insurance without clear rules on routes, axle-load limits and toll charges.

On the rail side, service-level agreements and slot guarantees will be vital. Shippers will only shift to trains if reliability is legally enforceable. Without those contractual frameworks, the fear is that trucks will remain the default.

Finance, competition and community impact

The Port of Gauteng is presented as a private-sector project, funded through equity, land sales and rail-park participation rather than government subsidies. The developers point to the expiry of the N3 toll concession in 2029 as a window for reform, with tolling structures potentially aligned to support PBS adoption and corridor decongestion.

Competition is inevitable. The Port’s scale and design will draw business away from Johannesburg’s existing inland terminal at City Deep. That raises questions of labour transfer, community impact and equitable development. While the paper highlights the 50 000 jobs, it does not yet provide detail on skills transfer or mitigation plans for displaced workers.

Environmental and decarbonisation benefits

Sustainability is built into the concept. Integrated solar and recycling systems will reduce operational footprints. Shifting more freight onto rail and using fewer, more efficient PBS trucks will lower emissions per container, but the White Paper stops short of offering quantified carbon reduction targets, something shippers and investors will increasingly demand.

Editor’s comment: FleetWatch has long said the road-to-rail debate is not about talk-shops but about actual delivery. The Port of Gauteng White Paper is the most ambitious private-sector plan tabled to date. It puts reliability and smarter trucking at the heart of its design, and it spells out the failures that have paralysed the corridor for a decade. But ambition alone will not move containers.

The test will be execution: can regulators provide certainty on PBS? Can private rail operators guarantee performance? Can financing be secured without political delay?

For fleet operators the watchwords are caution and opportunity. Stress-test the business case, model the PBS economics and demand firm rail guarantees before investing. If these pieces align, the Durban–Gauteng corridor could finally shift from crisis to competitiveness. If not, the trucks will keep rolling and the N3 will remain South Africa’s most fragile artery. Also, as stated, the developers believe they can remove up to 40 percent of truck movements from the N3 while still improving efficiency. So where do those trucks go to earn a living?

Click on photographs to enlarge