Data recently released by naamsa The Automotive Business Council shows that South Africa’s new vehicle market delivered a long-awaited milestone in 2025, finally surpassing pre-pandemic 2019 levels and reaching volumes not seen in more than a decade. The heavy truck and bus segments, however, were the exception to sales surges experienced in other segments.

According to naamsa, the sector’s recovery was closely aligned with broader macroeconomic improvements, supported by cumulative interest rate cuts of 150 basis points since September 2024, record-low vehicle inflation, an influx of more affordable imports and the liquidity boost from two-pot retirement system withdrawals.

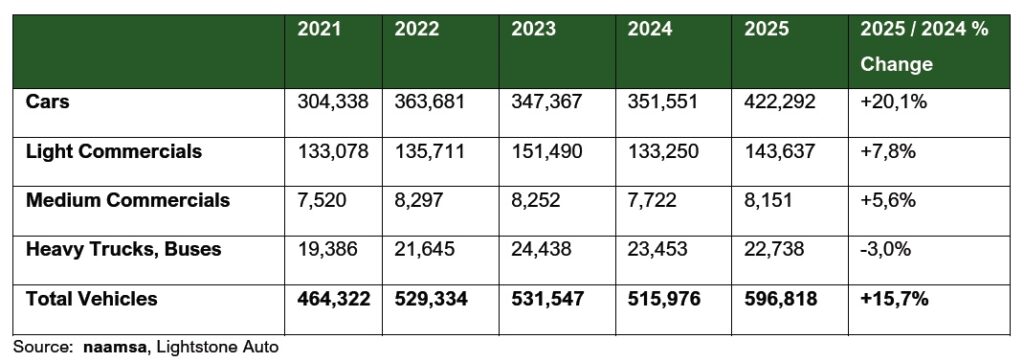

naamsa data confirms that aggregate industry sales grew by a robust 15,7% year-on-year to 596 818 units in 2025, reflecting renewed consumer confidence, improved credit conditions and the release of pent-up demand that had accumulated between 2021 and 2024.

naamsa December figures underline uneven recovery

According to naamsa, December 2025 provided a strong conclusion to the year, with total new vehicle sales reaching 48 983 units, up from 41 101 units in December 2024. The naamsa figures show passenger car sales rising 20,3% year-on-year, while light commercial vehicles increased by 23,7%, reinforcing the strength of consumer-facing segments.

However, naamsa’s December breakdown highlights continued pressure in the commercial vehicle space. Medium commercial vehicle sales declined by 7,0% year-on-year, while heavy trucks and buses recorded a sharper 13,2% contraction, indicating on-going caution among fleet operators.

Dealer sales accounted for 90,8% of December volumes, according to naamsa, with the remainder split between rental, government and corporate fleets.

naamsa trend data shows mixed fortunes for heavy trucks

Full year naamsa data underscores the divergent performance across segments. Passenger car sales surged by 20,1% to 422 292 units, while light commercial vehicles grew by 7,8% to 143 637 units. Medium commercial vehicles edged higher by 5,6% to 8 151 units.

In contrast, naamsa reports that heavy truck and bus sales declined by 3,0% year-on-year to 22 738 units. While volumes remain well above pandemic-era lows, the segment has cooled since peaking in 2023, reflecting the sector’s sensitivity to infrastructure constraints, freight demand and capital investment confidence.

For the trucking industry, the naamsa data reinforces that recovery remains uneven. While consumer-driven demand has powered the broader market, heavy commercial vehicle purchases continue to hinge on tangible progress in logistics reform and corridor performance.

Moreover, the rise of affordable Chinese heavy trucks represents a real market dynamic that could reshape the segment’s outlook. As Chinese manufacturers intensify export efforts into Africa – driven by the need to offset slower domestic demand – South African fleets are facing imports that undercut traditional price points. This is injecting competition into the heavy truck space, offering operators cost relief on initial purchase costs but also posing strategic challenges for local and established global OEMs seeking to protect market share.

naamsa export figures breach 400,000-unit milestone

On the export front, naamsa reports that vehicle exports reached 408 224 units in 2025, a year-on-year increase of 4,4% and the first time exports have exceeded the 400 000-unit mark.

Passenger car exports softened by 8,0%, according to naamsa, while light commercial vehicle exports rose sharply by 33,3%. Truck and bus exports increased by 68,4% off a low base, underscoring South Africa’s continued relevance in selected commercial vehicle export niches.

naamsa has cautioned that while regulatory adjustments in Europe provide limited relief, the transition to new energy vehicles remains an existential priority for export competitiveness. The association continues to monitor geopolitical risks, including trade tensions with the US and uncertainty around AGOA.

naamsa outlook for 2026 remains positive, but conditional

Looking ahead, naamsa expects the combined impact of lower interest rates and easing inflation, forecast to average 3,3%, to support consumer spending in 2026. With GDP growth projected at between 1,4% and 1,6%, naamsa forecasts new vehicle sales growth of between 9% and 11% in 2026.

For heavy trucks and buses, naamsa notes that upside potential will depend less on consumer conditions and more on execution in logistics reform, infrastructure recovery and the effective rollout of private sector participation in rail and ports.

Editor’s comment: naamsa’s 2025 data paints a strong overall picture for South Africa’s automotive market, yet it also highlights persistent structural challenges in the heavy truck segment. While passenger and light commercial vehicles have benefited from affordability and demand revival, heavy trucks remain constrained by logistics bottlenecks and cautious fleet investment.

Against this backdrop, the prospect of Chinese truck imports gaining traction adds another layer of complexity. Lower-priced models could offer short-term cost relief for operators, but they also risk intensifying competitive pressure on local and established global OEMs.

Ultimately, market shifts of this nature reinforce the need for infrastructure reform and logistics efficiency – because without reliable transport corridors, no amount of competitive pricing will unlock sustainable growth in heavy commercial fleets. If logistics execution accelerates, the heavy truck market could harness competitive imports as an additional growth vector; if not, it may continue to lag.

Click on photographs to enlarge