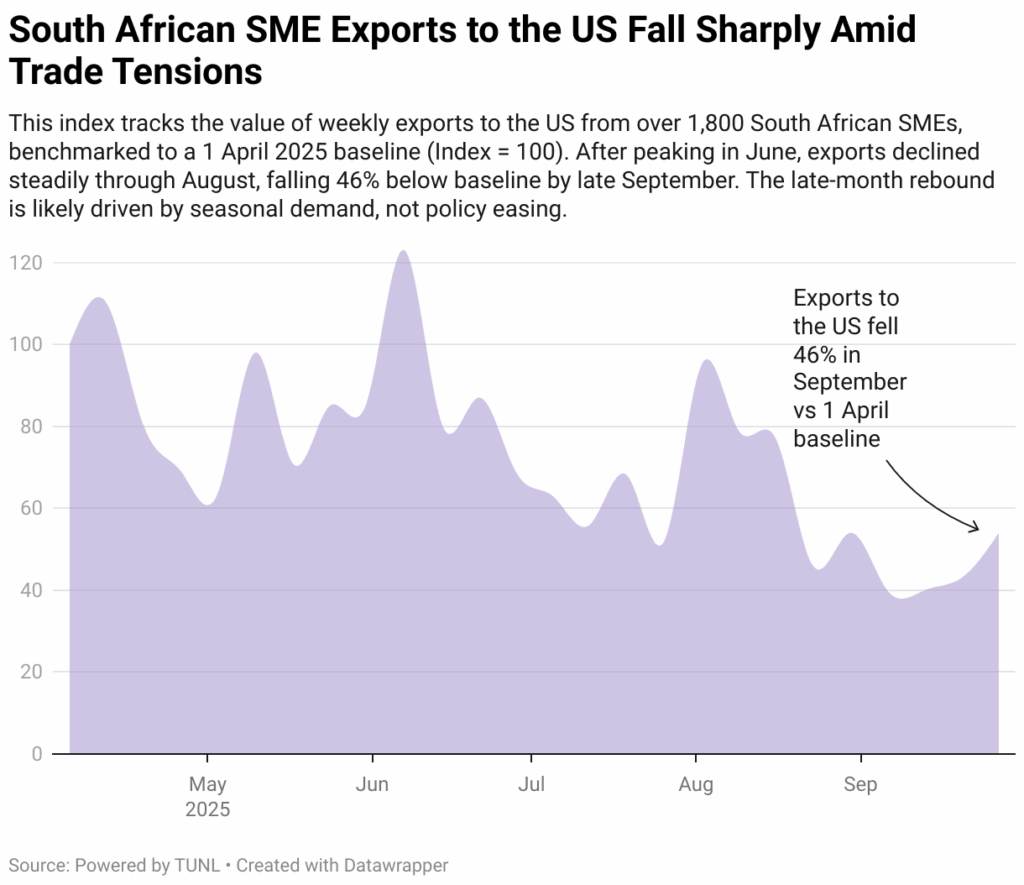

South African small direct-to-consumer exporters are feeling the full force of US tariffs, with shipments plummeting 46% since April 2025. New data from the SME Export Index, launched recently by international shipping platform TUNL, highlights the knock-on effects for the local freight and trucking sector, which moves these goods to ports and airports for global delivery.

The SME Export Index tracks real shipping volumes from a fixed cohort of 1 850 South African exporters, including household names such as Ciovita, Versus Socks, Freedom of Movement, Old School Brand, and Melvill & Moon. It provides a monthly barometer of how US tariffs affect small exporters and the logistics chains that support them.

Tariff shock ripples through freight networks

Craig Lowman, TUNL CEO and co-founder, says: “Although the new 30% reciprocal tariffs were announced in April, consumers were largely shielded by the $800 de minimis waiver, which allowed packages valued at under $800 to enter the US duty-free.”

That waiver was revoked on 29 August 2025, meaning all packages are now charged a tariff, irrespective of value. “Our data shows a 46% drop in South African SME export volumes to the US last month, compared to the 1 April 2025 baseline, which we chose because it was just before the new tariffs were announced,” Lowman adds.

“SMEs represent jobs, entrepreneurship and the future of South African cultural exports,” he continues. “The US tariffs have landed like a sledgehammer on our merchant community of small exporters, who are being priced out of the US market.”

TUNL COO Aretha Cooper highlights the pressure on freight operators: “For SMEs, there’s just no room to absorb that kind of cost. Logistics providers, truckers and freight forwarders feel the impact too, as volumes drop and shipments are delayed or cancelled. This is a global macroeconomic situation affecting many small businesses and the supply chains that support them.”

She adds: “We believe transparent costs are critical to convert browsers into buyers, which is why we are helping local SMEs with tools to clearly display duties and taxes at their checkouts. For some merchants, it makes more sense to pivot exports to other geographies, where existing trade agreements can provide relief from duties.”

Mark Fanner, owner of Fanner Guitar Works, which exports handmade ukuleles and guitars, says: “It absolutely destroyed my business. The first weeks after the new tariffs, there were no orders from the States. We now have to add about 39% to every shipment, between tariffs, duties and fees. Sales are down roughly 50% and our refund rate has tripled since August.”

For fleet operators, freight brokers and logistics managers, these figures are a warning. Volumes are shrinking, shipping schedules are under pressure and the ability to plan routes efficiently is increasingly complex.

TUNL will release SME Export Index data monthly, ensuring small exporters and the freight networks that serve them remain visible in the national tariff debate.

Editor’s comment: The lesson for trucking and logistics is clear: the health of small exporters directly impacts freight volumes, scheduling and revenue streams. Tracking SME exports is no longer just a trade story – it’s a fleet story. Trucking companies that can adapt to rapidly changing volumes, pivot routes and integrate real-time shipping data will be the ones that protect margins and maintain efficiency in a market disrupted by tariffs. Additionally, for South Africa’s economy to grow equitably, SMEs need our support – particularly in advice on logistics chain alternatives to disrupted traditional channels.

Click on photographs to enlarge