South Africa’s road freight industry may be thousands of kilometres away from the conflict zones in the Middle East and Ukraine, but growing global geopolitical instability is disrupting international shipping routes effectively risking the smooth flow of cargo across marine and land freight corridors.

The 2025 Allianz Safety and Shipping Review reveals that while traditional maritime risks are improving, escalating global tensions – including the US-China trade war, shadow fleets and attacks on vessels – are fuelling uncertainty and challenging the resilience of global shipping. For South African trucking and logistics, the knock-on effects could be costly.

With 90% of global trade moving by sea, threats to maritime supply chains ultimately ripple through to land transport. Delays at sea mean fewer goods at port – and that’s bad news for local fleets reliant on stable imports to keep industries and distribution centres moving.

And it’s not just imports under pressure. South African exports – from citrus and wine to minerals and manufactured goods – also depend on reliable access to global sea lanes. Longer routes, vessel backlogs and rising shipping insurance premiums can delay delivery windows, dent competitiveness and cut into the margins of local producers relying on global markets.

Shadow fleets and shady trading policies

According to the 2025 Allianz Safety and Shipping Review, geopolitical headwinds are intensifying. The ongoing US-China trade dispute and a ballooning ‘shadow fleet’ of ageing tankers moving sanctioned oil are shaking up the shipping industry’s already complex operating environment.

The US imposed tariffs as high as 145% on Chinese goods before a temporary 90-day easing period. As a result, nearly 18% of global maritime trade was under tariff restrictions by April 2025 – up from just 4% in March.

At the same time, the rise of the so-called shadow fleet – now making up 17% of the global tanker fleet – has raised red flags for insurers and port authorities. These vessels are often poorly maintained, fly flags of convenience and avoid standard regulatory oversight.

“Although recent sanctions are making it harder for these vessels to trade, the shadow fleet continues to pose a serious risk to maritime safety and the environment, as many are likely to be older vessels that are poorly maintained and inadequately insured. In case of an oil spill involving a shadow fleet tanker, cleanup costs could be as much as US$1.6-billion,” says Justus Heinrich, global product leader, Marine Hull, Allianz Commercial.

Fewer ship losses but conflicts pose new risk

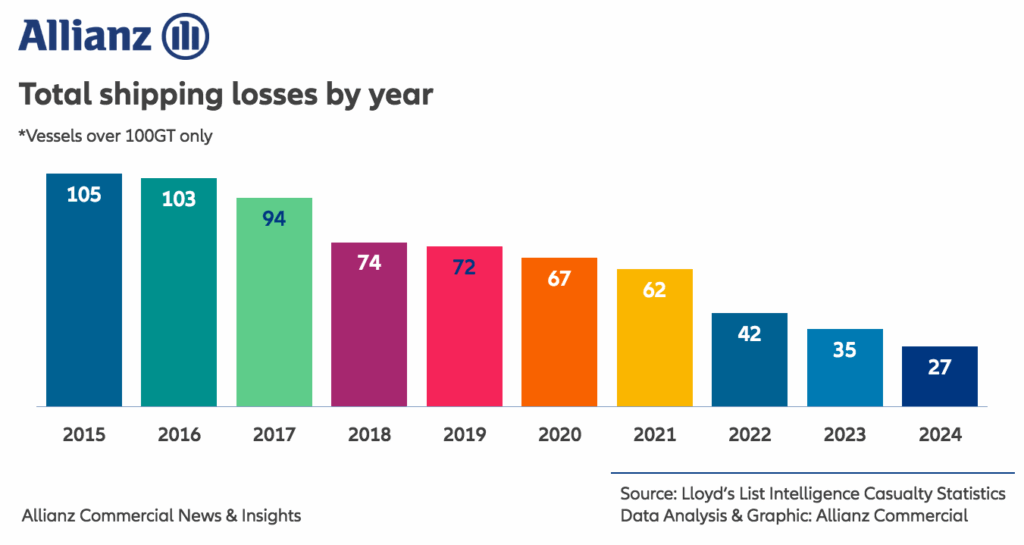

Despite the turmoil, says Allianz, maritime safety has improved in some areas. Only 27 large vessels were lost in 2024 – a record low and a 20% drop from 2023. For perspective, the global fleet lost over 200 vessels annually in the 1990s.

According to Captain Rahul Khanna, global head of Marine Risk Consulting, Allianz Commercial: “There is little doubt the shipping industry is becoming more resilient against the risks associated with large vessels, although we can by no means say they are under control. However, only 27 total losses during 2024 underlines the positive trend.

“To put this into perspective: there are over 100 000 ships (100GT+) in the global fleet. However, uncertainty and multiple risks persist. Cyber-attacks and GPS interferences are increasing. Ceasefires have raised hopes, but the Red Sea security threat and supply chain disruption will likely remain. Meanwhile, the green transition requires much work. The coming years will be decisive and will determine the path of the sector and global trade.”

Despite new threats, persistent risks remain: fires, especially aboard container and ro-ro vessels, are still a top concern. Of 250 fire-related incidents in 2024 (a decade high), 69 involved cargo-carrying vessels. Mis-declared or improperly stored cargo – often lithium-ion batteries – are a common cause and while regulatory efforts and technology upgrades are underway to reduce these hazards, enforcement remains patchy, the Review states.

The focus for insurers is shifting. Traditional causes of loss – groundings, collisions and onboard fires – are declining but political unrest is gaining ground as a dominant threat.

Captain Khanna concludes: “The relevance of political risk and conflict as a potential cause of maritime loss is increasing with heightened geopolitical tensions. Total losses from traditional causes may have reduced over time, but we could be in a position where this positive trend is potentially offset by war and other political-related exposures. As an industry, we are in a better position with regards to traditional risks but there is a renewed focus on geopolitical risks.”

Editor’s comment: For a country heavily reliant on ocean freight to feed its land-based supply chains, South Africa can’t afford to ignore shipping disruptions. Delays, diversions around hotspots like the Red Sea and higher insurance premiums all feed into local cost structures – putting pressure on importers, distributors and trucking operations.

Meanwhile, the ripple effects extend to South African exporters too. Reduced vessel availability and unpredictable lead times can break cold chain integrity for perishables, disrupt bulk commodity shipments and undermine hard-earned trading relationships in key export markets.

As conflict zones shift and climate goals introduce stricter supply chain compliance requirements, the next few years will be pivotal. Logistics players across all modes – road, rail and sea – will need to keep one eye on international waters and the other on their risk mitigation and forward planning.

Ends